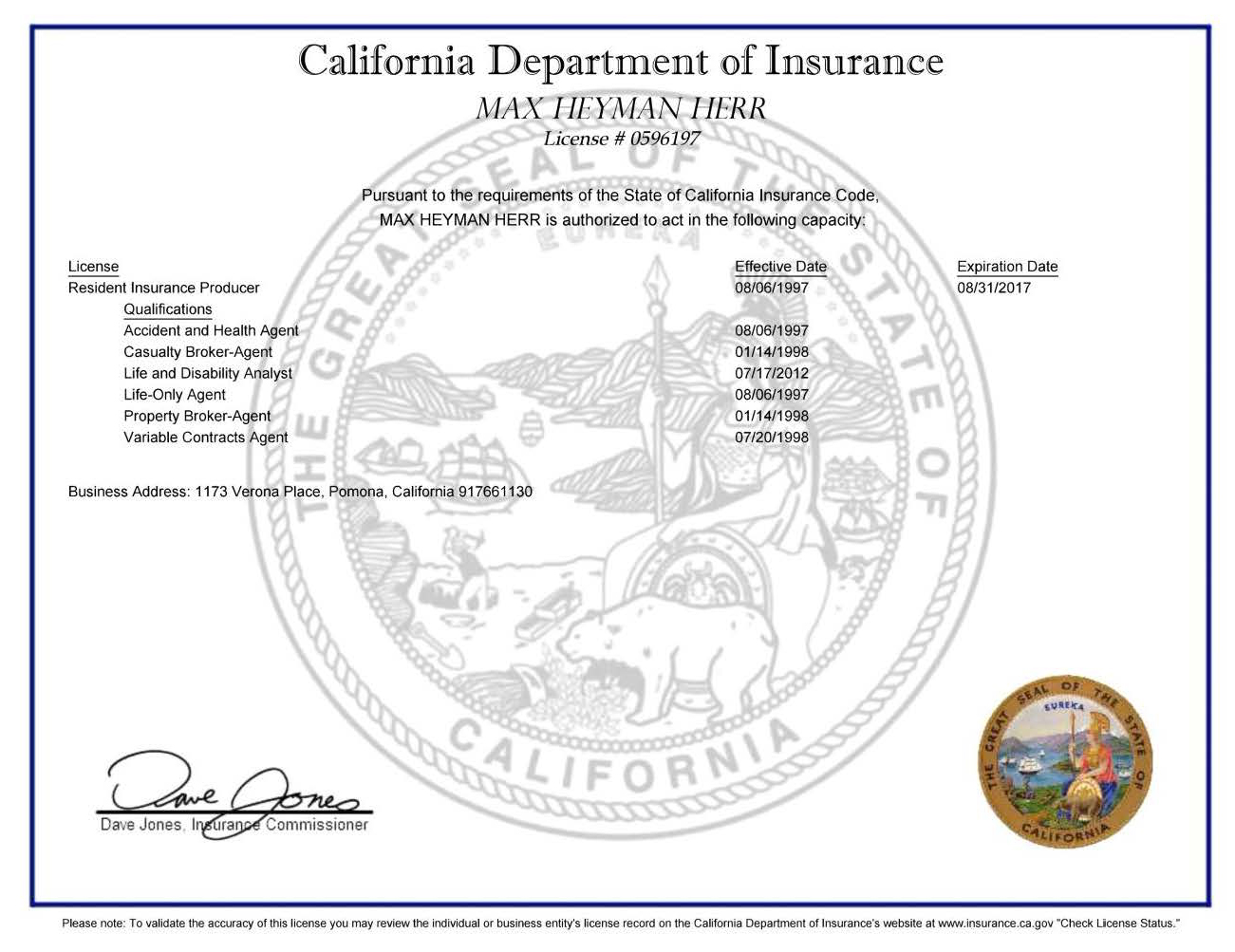

Agent # 2000001402 Certification # 5000003213

Only a Certified Insurance Agent has authority to submit your enrollment application for health insurance through the Covered California Individual or SHOP Exchange.

As

an insurance consumer, you should only transact insurance with persons who are properly

licensed as resident or nonresident agents and/or brokers in your state. California is one of only two states which require the agent's insurance license number to be printed on business cards, letterhead, price or premium quotations, and in most advertising -- the license number is supposed to be the same size as the largest address or telephone number on the document. You may easily verify the validity of an agent's or agency's license at most states' Department of Insurance website.

If you are considering a variable life insurance or variable annuity product, you should also check the FINRA or Securities and Exchange Commission (SEC) registration of the registered representative or investment adviser proposing the policy to you (they must have both insurance and securities licenses). All variable insurance and annuity product transactions must be preceded or accompanied by a current prospectus describing the various investment subaccount options available within the insurance company's Separate Account.

In most cases, your insurance policies will be issued by companies "admitted" (authorized) to transact

insurance in your state. Some non-standard property and casualty insurance risks may

have to be covered by "eligible nonadmitted insurers," and such insurance may

only be obtained through a licensed Surplus Line Broker in your state. It's always a good idea to make sure your insurance company is admitted to transact insurance in your state, or is one of the eligible nonadmitted insurers which may insure risks in your state. In California, Workers' Compensation insurance must be obtained from an admitted insurer (purchasing Workers' Compensation from a nonadmitted insurer is unlawful, and may result in an employer being charged with and prosecuted for Workers' Compensation insurance fraud.)

Max Herr is licensed to transact insurance in California. This site is not intended to solicit or result in transacting insurance in any form with residents of other states.

California does not issue non-resident Life and Disability Insurance Analyst licenses. Comparable resident licenses in other states may be known as an Insurance Counselor or Insurance Adviser. Pursuant to a written agreement, a California-licensed Life and Disability Insurance Analyst may provide

policy analysis and related services to any person in any state, territory, or possession of the

United States.

Verify the licensing of your California insurance agent, insurance agency, or insurance company!

Verify the registration of your stock broker, registered representative, or investment adviser!

CIC §31. "Insurance agent" means a person authorized, by and on behalf of an insurer, to transact all classes of insurance other than life, disability, or health insurance, on behalf of an admitted insurance company.

CIC §32. (a) A life licensee is a person authorized to act as a life agent on behalf of a life insurer or a disability insurer to transact any of the following: (1) Life insurance. (2) Accident and health insurance. (3) Life and accident and health insurance. (b) Licenses to act as a life agent under this chapter shall be of the types as set forth in Section 1626. (c) A life agent may be authorized to transact 24-hour care coverage, as defined in Section 1749.02, pursuant to the requirements of subdivision (d) of Section 1749 or subdivision (b) of Section 1749.33.

CIC §32.5. "Life and disability insurance analyst" means a person who, for a fee or compensation of any kind, paid by or derived from any person or source other than an insurer, advises, purports to advise, or offers to advise any person insured under, named as beneficiary of, or having any interest in, a life or disability insurance contract, in any manner concerning that contract or his or her rights in respect thereto.

CIC §33. "Insurance broker" means a person who, for compensation and on behalf of another person, transacts insurance other than life, disability, or health with, but not on behalf of, an insurer. 33.5. (a) "Casualty broker-agent" means a person licensed pursuant to Section 1625. (b) "Property broker-agent" means a person licensed pursuant to Section 1625.

CIC §34. "Insurance solicitor" means a natural person employed to aid a property and casualty broker-agent acting as an insurance agent or insurance broker in transacting insurance other than life, disability, or health.

CIC §35. "Transact" as applied to insurance includes any of the following: (a) Solicitation. (b) Negotiations preliminary to execution. (c) Execution of a contract of insurance. (d) Transaction of matters subsequent to execution of the contract and arising out of it.

CIC §47. "Surplus line broker" means a person licensed under Section 1765 and authorized to do business under Chapter 6 (commencing with Section 1760) of Part 2 of Division 1.

CIC §1633. Any person who transacts insurance without a valid license so to act is guilty of a misdemeanor punishable by a fine not exceeding fifty thousand dollars ($50,000) or by imprisonment in a county jail for a period not exceeding one year, or by both that fine and imprisonment.

"CIC" is California Insurance Code